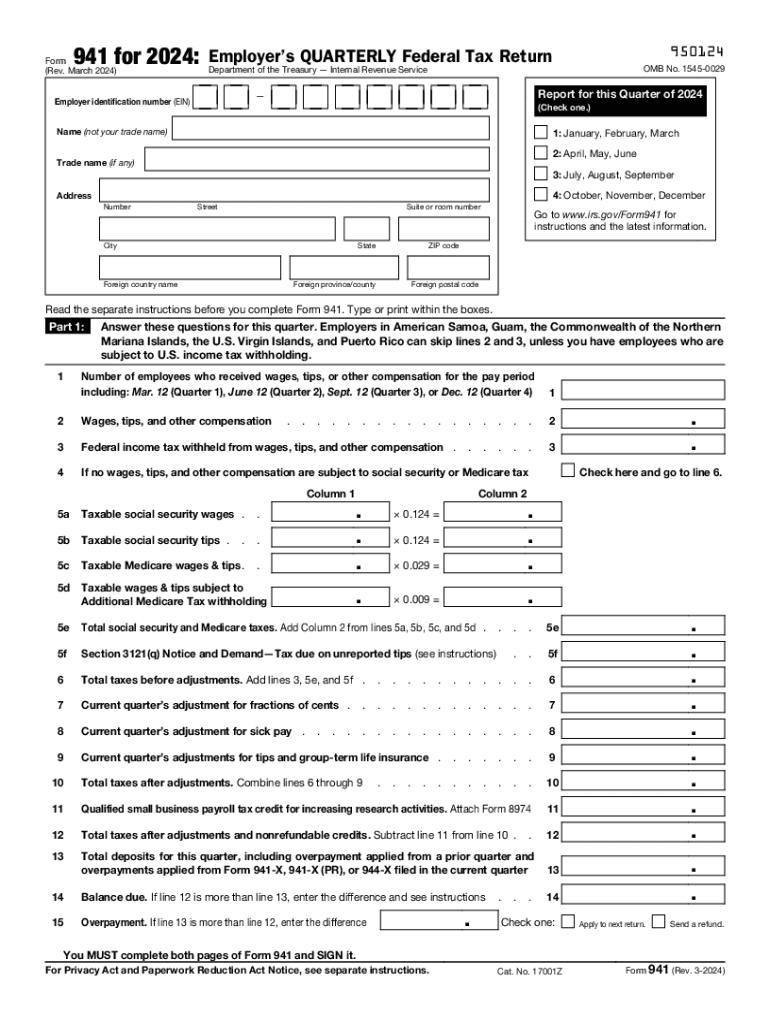

2024 January Calendar Blank Form 941 – First quarter (January, February, March) Second quarter (April, May, June) Third quarter (July, August, September) Fourth quarter (October, November, December) The deadlines for filing Form 941 . Because of that, I have included TWO January calendar pages. One starts on Sunday, and the other starts on Monday. Choose whatever works best for you! The PDF file is completely free. After you .

2024 January Calendar Blank Form 941

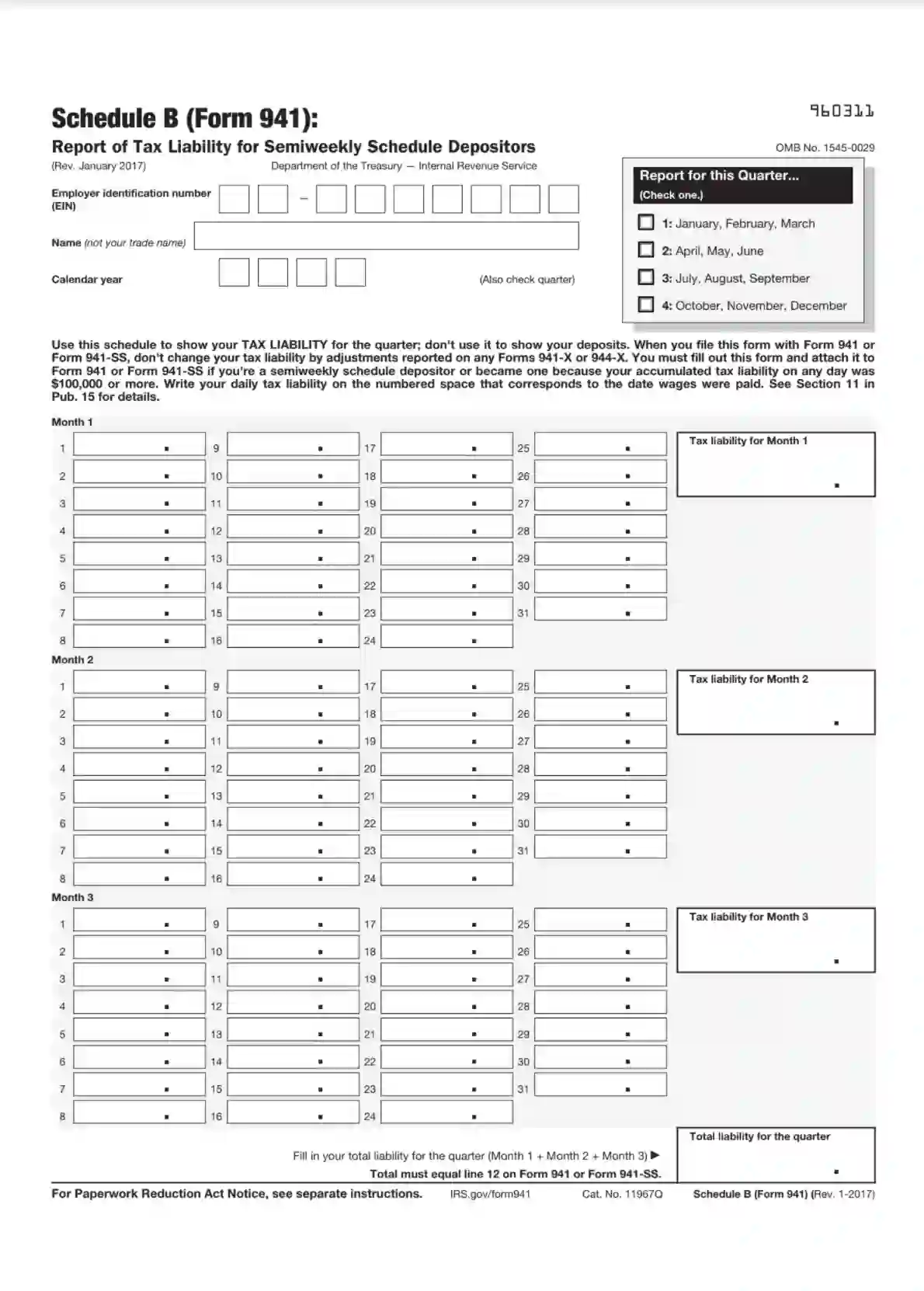

Source : www.irs.govIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.com2024 tax calendar Miller Kaplan

Source : www.millerkaplan.comPremium Vector | 2024 modern wall calendar template design

Source : www.freepik.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govQuarterly calendar hi res stock photography and images Alamy

Source : www.alamy.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2024 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Source : 941-form.pdffiller.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov7 Tips for Filing IRS Form 941: Employer’s Quarterly Federal Tax

Source : blog.workful.com2024 January Calendar Blank Form 941 3.11.13 Employment Tax Returns | Internal Revenue Service: You pay the federal employer taxes on a quarterly basis–March, June, September and December–and submit the payment with Internal Revenue Service Form 941 Leave the box blank if this is . October 31st and January 31st. Form 944 is used instead of Form 941 when a business’s Medicare, Social Security and federal tax withholding liability are less than $1,000 for the calendar year. .

]]>